¨ Fee paid previously with preliminary materials.

¨ Check box if any part of the fee is offset as provided by Exchange Act Rule 0-11(a)(2) and identify the filing for which the offsetting fee was paid previously. Identify the previous filing by registration statement number, or the Form or Schedule and the date of its filing.☐ | Fee paid previously with preliminary materials. |

☐ | Check box if any part of the fee is offset as provided by Exchange Act Rule 0-11(a)(2) and identify the filing for which the offsetting fee was paid previously. Identify the previous filing by registration statement number, or the Form or Schedule and the date of its filing. |

| 1) | Amount Previously Paid: |

| 2) | Form, Schedule or Registration Statement No.: |

NOTICE OF ANNUAL MEETING OF STOCKHOLDERS To Be Held

TO BE HELD April 24, 201427, 2017

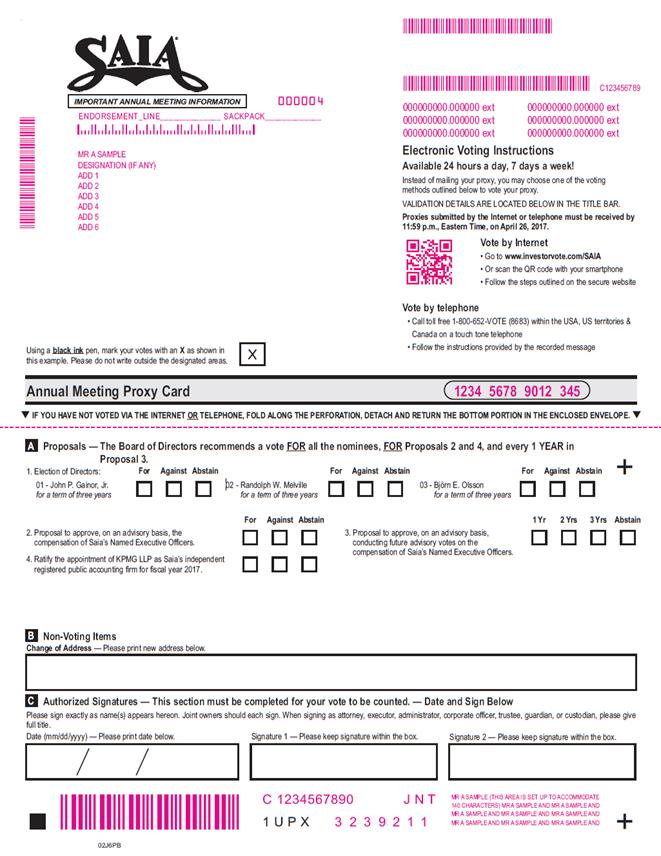

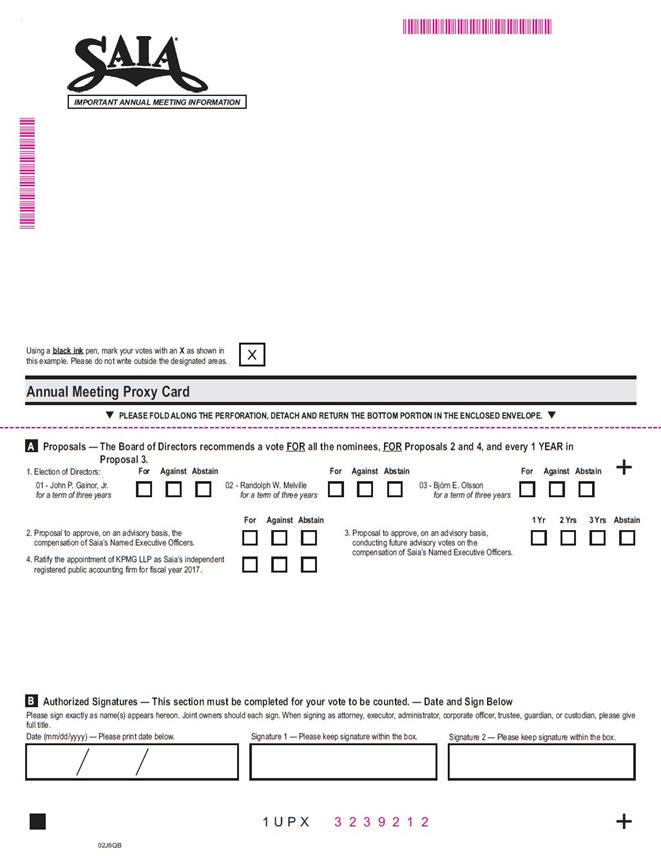

To Our Stockholders: We cordially invite you to attend the 20142017 annual meeting of stockholders of Saia, Inc. The meeting will take place at the Renaissance Concourse Atlanta Airport Hotel, One Hartsfield Centre Parkway, Atlanta, Georgia 30354 on April 24, 201427, 2017 at 10:30 a.m. local time. We look forward to your attendance, either in person or by proxy. The purpose of the meeting is to: | 1. | Elect three directors, each for a term of three years; |

| 2. | Vote on an advisory basis to approve the compensation of Saia’s Named Executive Officers; |

| 3. | Vote on an advisory basis on the frequency of future advisory votes on the compensation of Saia’s Named Executive Officers; |

| 4. | Ratify the appointment of KPMG LLP as Saia’s independent registered public accounting firm for fiscal year 2017; and |

| 5. | 1. Elect three directors, each for a term of three years;

2. Vote on an advisory basis to approve the compensation of Saia’s Named Executive Officers;

3. Ratify the appointment of KPMG LLP as Saia’s independent registered public accounting firm for fiscal year 2014; and

4. Transact any other business that may properly come before the meeting and any postponement or adjournment of the meeting.

|

Only stockholders of record at the close of business on March 10, 20148, 2017 may vote at the meeting or any postponements or adjournments of the meeting. By order of the Board of Directors,

James A. Darby

Frederick J. Holzgrefe, III

Secretary March 21, 20142017 Please complete, date, sign and return the accompanying proxy card or vote by telephone or the internet. The enclosed return envelope requires no additional postage if mailed in either the United States or Canada. Alternatively, you may vote electronically via the internet. Go towww.investorvote.com/saia and follow the steps outlined on the secure website. If you are a registered stockholder, you may elect to have next year’s proxy statement and annual report made available to you via the internet. We strongly encourage you to enroll in this service. It is a cost-effective way for us to send you proxy materials and annual reports. Your vote is very important. Please vote whether or not you plan to attend the meeting.

PROXY SUMMARY This summary highlights information contained elsewhere in this proxy statement. This summary does not contain all of the information that you should consider and you should read the entire proxy statement before voting. For more complete information regarding the Company’s 20132016 performance of Saia, Inc. (the “Company”), please review the Company’s Annual Report on Form 10-K. 20142017 Annual Meeting of Stockholders

April 24, 2014,27, 2017, 10:30 a.m., local time Renaissance Concourse Atlanta Airport Hotel One Hartsfield Centre Parkway Atlanta, Georgia 30354 March 10, 20148, 2017 Voting Matters and Board Recommendations | | | | | Our Board’s Recommendation | Election of Three Directors (page 5)6) | | FOR each Director Nominee | Advisory Vote to Approve Executive Compensation (page 49)58) | FOR | Advisory Vote on Frequency of Future Advisory Votes on Executive Compensation (page 59) | FOREVERY YEAR | Ratification of Appointment of Independent Registered Public Accounting Firm (page 50)60) | | FOR |

2013

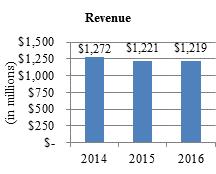

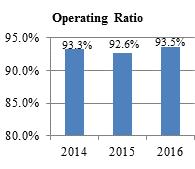

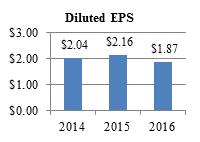

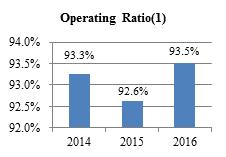

2016 Business Highlights In 2013,2016, the Company continued to effectively execute its long-term strategic plan and delivered strong operating results. Business highlights included: Revenues grew 3.6% to $1,139 millionresults in 2013, compared to $1,099 million in 2012.

Operating income grew 26.7% to $74.4 million in 2013, compared to $58.7 million in 2012.

Operating Ratio improved to 93.5% in 2013 from 94.7% in 2012.

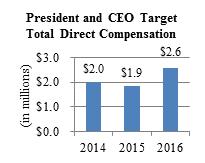

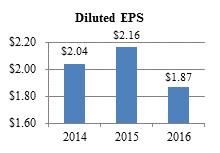

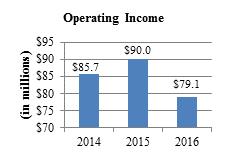

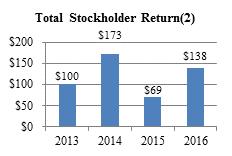

Diluted earnings per sharespite of $1.73 in 2013, compared to $1.29 in 2012 (adjusted to reflecta challenging environment. The following illustrates the three-year directional relationship between Company performance, based on four of the Company’s June 2013 three for two stock split).key operating metrics, and the compensation (as defined below) of Saia’s President and Chief Executive Officer.

i

Director Nominees (page 5)6) The Board of Directors consists of nine directors divided into three classes. Directors in each class are elected to serve for three-year terms that expire in successive years. The terms of the Class III directors will expire at the upcoming annual meeting. The Board of Directors has nominated the following persons for election as Class III directors for three-year terms expiring at the annual meeting of stockholders to be held in 2017.2020. Each nominee is currently a director of Saia. | | | | | | | | | | | | | Name | | Age | | | Director

Since | | | Primary Occupation | | Committee Memberships | Linda J. French* | | | 66 | | | | 2004 | | | Retired Professor of Business Administration; Former General Counsel at Payless Cashways, Inc. | | Compensation (Chair) | William F. Martin, Jr.* | | | 66 | | | | 2004 | | | Retired General Counsel and Executive Officer of Yellow Corporation | | Nominating and Governance (Chair); Audit | Bjorn E. Olsson*† | | | 68 | | | | 2005 | | | Retired President and CEO of Harmon Industries | | Compensation; Nominating and Governance |

Name | | Age | | Director Since | | Primary Occupation | | Committee Memberships | John P. Gainor, Jr.* | | 60 | | 2016 | | President and CEO of International Dairy Queen, Inc. | | Audit | Randolph W. Melville* | | 58 | | 2015 | | Senior VP and General Manager of Frito-Lay North America, Western Division | | Compensation | Björn E. Olsson*± | | 71 | | 2005 | | Retired President and CEO of Harmon Industries, Inc. | | Nominating and Governance |

†± | Lead Independent Director for 20132016 |

i

Management Proposals (pages 49 and 50)58-61) 1. | Advisory Vote to Approve Executive Compensation.Compensation. We are asking our stockholders to approve on an advisory basis our Named Executive Officer compensation. The Board recommends a FOR vote because it believes that our compensation policies and practices are effective in attracting, motivating and retaining talented executive officers and aligning the executives’ long-term interests with those of our stockholders. |

2. | Advisory Vote on the Frequency of Future Advisory Votes on Executive Compensation. We recommend that stockholders vote to hold an advisory vote on the compensation of Saia’s Named Executive Officers every year. An annual advisory vote on executive compensation will allow stockholders to provide direct input on Saia’s compensation philosophy, policies and practices every year. Additionally, an annual advisory vote on executive compensation is consistent with Saia’s policy of seeking input from, and engaging in discussions with, its stockholders on executive compensation and corporate governance matters. |

2.3. | Ratification of Appointment of Independent Registered Public Accounting Firm.Firm. As a matter of good governance, we are asking our stockholders to ratify the selection of KPMG LLP as our auditors for 2014.2017. |

ii

Corporate Governance (page 10)12) Saia has the following corporate governance provisions and policies: | • | | Separate Chief Executive Officer and Chairman of the Board. The Chief Executive Officer is responsible for setting the strategic direction for the Company and the day-to-day leadership and performance of the Company, while the Chairman provides guidance to the Chief Executive Officer, sets the agenda for Board meetings and presides over meetings of the full Board.

|

| • | | The Board has a Lead Independent Director. The Lead Independent Director position ensures the Board has a director in a leadership position that is “independent” under all applicable rules of the NASDAQ Global Select Market and the Securities and Exchange Commission. The Lead Independent Director is elected annually by the independent directors. For 2013, the Lead Independent Director was Björn E. Olsson.

|

| • | | Majority Voting for Director Elections. Saia’s Bylaws require that in an uncontested election a nominee to the board must receive more votes cast for than against his or her election in order to be elected to the Board. If an incumbent director fails to receive a majority of the vote for reelection, the Nominating and Governance Committee recommends to the full Board whether to accept or reject the nominee’s previously submitted resignation, and the full Board makes the final determination. We believe the ability of stockholders to vote for or against a director, as opposed to merely withholding a vote for a director, increases accountability to stockholders. The election of directors at the 2014 annual meeting of stockholders is an uncontested election.

|

| • | | Three Standing Committees of the Board of Directors: the Audit Committee, the Compensation Committee and the Nominating and Governance Committee. Saia’s Board committees are comprised entirely of independent directors. Saia’s committee charters are available free of charge on the Company’s website (www.saiacorp.com) under the investor relations section.

|

| • | | Stock Ownership Guidelines. The Company has adopted stock ownership guidelines that apply to all officers who are eligible to receive long-term incentives, including all Named Executive Officers, and to Saia’s directors. At March 1, 2014, all of the Named Executive Officers were in compliance with the guidelines.

|

| • | | Compensation Recovery Policy. The Company has a “clawback” policy for performance-based compensation where the payment was predicated on the achievement of financial results that were subsequently the subject of a material restatement and a lower payment would have been made based on the restated financial results.

|

| • | | Policy Against Hedging and Pledging of Saia Stock. Directors and employees subject to the Company’s insider trading policies may not engage in short sales of Saia common stock, in transactions involving puts, calls, or other derivative securities of the Company or in hedging transactions with respect to the Company. Additionally, directors and such employees are prohibited from holding Saia stock in a margin account and from pledging Saia common stock as collateral for indebtedness.

|

ii

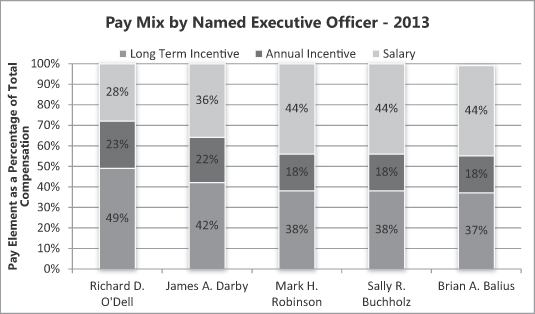

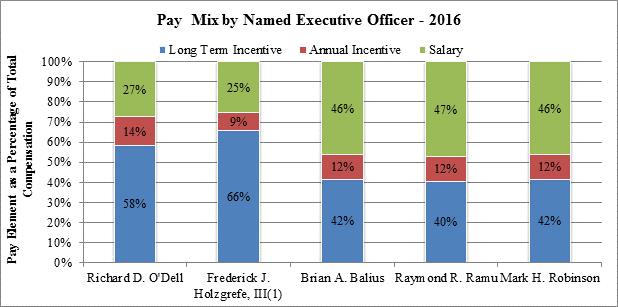

Separate Chief Executive Officer and Chairman of the Board. The Chief Executive Officer is responsible for setting the strategic direction for the Company and the day-to-day leadership and performance of the Company, while the Chairman provides guidance to the Chief Executive Officer, sets the agenda for Board meetings and presides over meetings of the full Board. The Board has a Lead Independent Director. The Lead Independent Director position ensures the Board has a director in a leadership position that is “independent” under all applicable rules of the NASDAQ Global Select Market and the Securities and Exchange Commission. The Lead Independent Director is elected annually by the independent directors. For 2016, the Lead Independent Director was Björn E. Olsson. Majority Voting for Director Elections. Saia’s Bylaws require that, in an uncontested election, a nominee to the Board must receive more votes cast for than against his or her election in order to be elected to the Board. If an incumbent director fails to receive a majority of the vote for reelection, the Nominating and Governance Committee recommends to the full Board whether to accept or reject the nominee’s previously submitted resignation, and the full Board makes the final determination. We believe the ability of stockholders to vote for or against a director, as opposed to merely withholding a vote for a director, increases accountability to stockholders. The election of directors at the 2017 annual meeting of stockholders is an uncontested election. Three Standing Committees of the Board of Directors: the Audit Committee, the Compensation Committee and the Nominating and Governance Committee. Saia’s Board committees are comprised entirely of independent directors. Saia’s committee charters are available free of charge on the Company’s website (www.saiacorp.com) under the investor relations section. Stock Ownership Guidelines. The Company has adopted stock ownership guidelines that apply to all officers who are eligible to receive long-term incentives, including all Named Executive Officers, and to Saia’s directors. Clawback Policy. The Company has a “clawback” policy for performance-based compensation where the payment was predicated on the achievement of financial results that were subsequently the subject of a material restatement and a lower payment would have been made based on the restated financial results. Policy Against Hedging and Pledging of Saia Stock. Directors and employees subject to the Company’s insider trading policies may not engage in short sales of Saia common stock, in transactions involving puts, calls, or other derivative securities of the Company or in hedging transactions with respect to the Company. Additionally, directors and such employees are prohibited from holding Saia stock in a margin account and from pledging Saia common stock as collateral for indebtedness. Executive Compensation Highlights (page 18)22) | • | | Saia aligns executives’ interests with those of our stockholders. Other than base salary, which is historically targeted at the 50th percentile of our peer group, all significant elements of executive compensation are based on Saia’s stock price performance, earnings per share or operating ratio. For 2013, the Company’s annual incentive plan was based on achieving earnings per share and operating ratio targets. The long-term incentive plan utilizes a combination of grants of shares of common stock based on the Company’s total stockholder return compared to that of companies in the peer group over a three year period and stock options with an exercise price set at fair market value on the grant date. Regardless of how the Company performs relative to its peers, no payouts of the stock grants are made unless the Company had positive stockholder return over the three year period. Saia’s stock option plans strictly prohibit repricing of stock options.

|

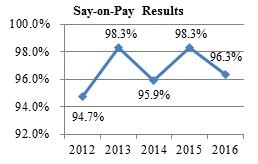

2013 Named Executive Officer Compensation2016 Say-on-Pay Results.

Realized Pay Differs from Reported Total Compensation. The SEC’s calculation In 2016, holders of total96.3% of our stock voting on the question approved on an advisory basis the compensation includes several items that are driven by accounting and actuarial assumptions, which are not necessarily reflective of compensation actually realized by Saia’s chief executive officer, chief financial officer and its three other most highly compensated executive officers (the “Named Executive Officers”) in 2013. To supplement the SEC-required disclosure, we have included an additional table that shows compensation actually realized by each of the Named Executive Officers in 2013. Set forth below are two tables showing for each named executive: (1) 2013 compensation actually realized by thepaid to our Named Executive Officers as reported on each named executive’s W-2 form (2013 Realized Compensation Table), and (2) 2013 compensation as determined under SEC rules (2013 Summary Compensation Table). For more information regarding amounts reporteddescribed in the 2013 Realized2016 proxy statement. The chart below shows the Company’s “say-on-pay” results over the past five years:

iii

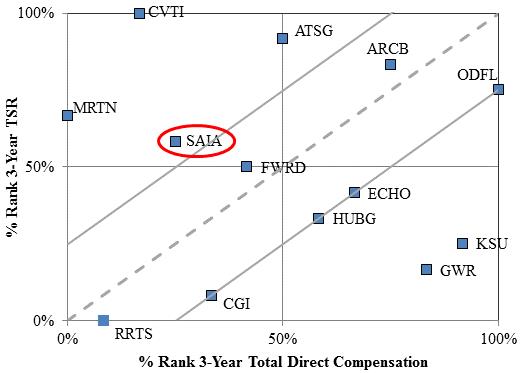

• | Saia Company Performance Outpaces CEO Compensation. As part of the 2016 compensation analysis performed by Mercer, the Compensation Committee reviewed the Company’s three-year total stockholder return (“TSR”) and three-year CEO “total direct compensation” for the period from 2013 – 2015. The graph below shows three-year TSR percentiles of the Company and other peer group companies. Saia’s three-year CEO total direct compensation (25th percentile) and three-year TSR (58th percentile) reflect that Saia’s performance outpaces the compensation of its CEO over that period. |

3-Year CEO Total Direct Compensation Table, see “2013 Realized Compensation” on page 35. The amounts reported in this table differ substantially(1) vs. 3-Year Stockholder Return(2)

| (1) | CEO total direct compensation reflects actual cash compensation earned for 2013 – 2015, in-the-money value of stock options, restricted stock and performance shares granted during 2013 – 2015 as of December 31, 2015 (for performance shares where performance period is complete, analysis reflects the actual number of shares earned; in other cases, the target number of shares was used). 2015 is the most recent year for which sufficient peer group data is available. TSR data was sourced by Mercer and compensation data is based on proxy statement disclosure for the peer group companies. |

| (2) | The shaded boxes represent the TSR of the Company and other peer group companies for the period from 2013 – 2015. Certain companies within our peer group were excluded from this analysis due to lack of sufficient data. |

iv

2016 Summary Compensation Table | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | Name & Principal Position | | Salary ($) | | | Bonus ($) | | | Stock Awards ($) | | | Option Awards ($) | | | Non-Equity Incentive Plan Compensation ($) | | | All Other Compensation ($) | | | Total ($) | | Richard D. O'Dell, | | | 706,335 | | | | — | | | | 700,002 | | | | 736,744 | | | | 369,971 | | | | 64,390 | | | | 2,577,442 | | President & Chief Executive Officer (PEO) | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | Frederick J. Holzgrefe, III, | | | 387,422 | | | | — | | | | 720,808 | | | | 232,393 | | | | 135,303 | | | | 50,489 | | | | 1,526,415 | | Vice President of Finance & Chief Financial Officer (PFO) | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | Brian A. Balius, | | | 312,553 | | | | — | | | | 115,866 | | | | 121,991 | | | | 81,661 | | | | 42,446 | | | | 674,517 | | Vice President of Transportation & Engineering | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | Raymond R. Ramu, | | | 342,610 | | | | — | | | | 127,505 | | | | 134,280 | | | | 89,851 | | | | 30,945 | | | | 725,191 | | Chief Customer Officer | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | Mark H. Robinson, | | | 296,933 | | | | — | | | | 110,075 | | | | 115,897 | | | | 77,580 | | | | 40,648 | | | | 641,133 | | Vice President of Information Technology & Chief Information Officer | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

See also the amounts reported as total compensation innarrative and footnotes accompanying the 2013 Summary Compensation Table and are not a substitute for those amounts. For a reconciliation of amounts reported as realized compensation and amounts reported as total compensation, see page 45. For more information on total compensation as calculated under SEC rules, see the narrative and notes accompanying the 2013 Summary Compensation Table set forth on page 36.41. 2013 Realized Compensation Table

| | | Name & Principal Position

| | Realized Compensation

| Richard D. O’Dell,

President & CEO

| | $3,170,342 | James A. Darby,

VP of Finance & CFO

| | 612,091 | Mark H. Robinson,

VP of Information Technology & CIO

| | 861,558 | Sally R. Buchholz,

VP of Marketing & Customer Service

| | 1,172,370 | Brian A. Balius,

VP of Transportation & Engineering

| | 979,315 |

iii

2013 Summary Compensation Table

| | | | | | | | | | | | | | | | | | | | | | | | | Name & Principal Position | | Salary

($) | | | Stock

Awards

($) | | | Option

Awards

($) | | | Non-Equity

Incentive Plan

Compensation

($) | | | All Other

Compensation

($) | | | Total

($) | | Richard D. O’Dell, President & Chief Executive Officer (PEO) (5) | | | 561,312 | | | | 331,834 | | | | 594,096 | | | | 468,134 | | | | 43,592 | | | | 1,998,968 | | James A. Darby, Vice President of Finance & Chief Financial Officer (PFO) | | | 304,500 | | | | 120,032 | | | | 214,799 | | | | 190,465 | | | | 27,639 | | | | 857,435 | | Mark H. Robinson, Vice President of Information Technology & Chief Information Officer | | | 253,764 | | | | 68,746 | | | | 123,131 | | | | 105,820 | | | | 24,101 | | | | 575,562 | | Sally R. Buchholz, Vice President of Marketing & Customer Service | | | 233,472 | | | | 63,262 | | | | 113,226 | | | | 93,389 | | | | 21,976 | | | | 525,325 | | Brian A. Balius, Vice President of Transportation & Engineering | | | 253,764 | | | | 68,746 | | | | 123,131 | | | | 105,820 | | | | 23,112 | | | | 574,573 | |

Important Dates for 20152018 Annual Meeting of Stockholders (page 54)64) Any stockholder who intends to submit a nomination or present a proposal at the annual meeting in 20152018 must deliver thesuch nomination or proposal to Saia’s corporate Secretary at 11465 Johns Creek Parkway, Suite 400, Johns Creek, Georgia 30097: On or after December 25, 2014, and on or before January 24, 2015, if the proposal is submitted pursuant to Saia’s By-Laws, in which case we are not required to include the proposal in our proxy materials.

Not later than November 21, 2014,2017, if the proposal is submitted for inclusion in our proxy materials for that meeting pursuant to Rule 14a-8 under the Securities Exchange Act of 1934. On or after December 28, 2017, and on or before January 27, 2018, if the nomination or proposal is submitted pursuant to Saia’s By-Laws, in which case we are not required to include the nomination or proposal in our proxy materials. ivv

Saia, Inc. 11465 Johns Creek Parkway, Suite 400

Johns Creek, Georgia 30097

20142017 PROXY STATEMENT

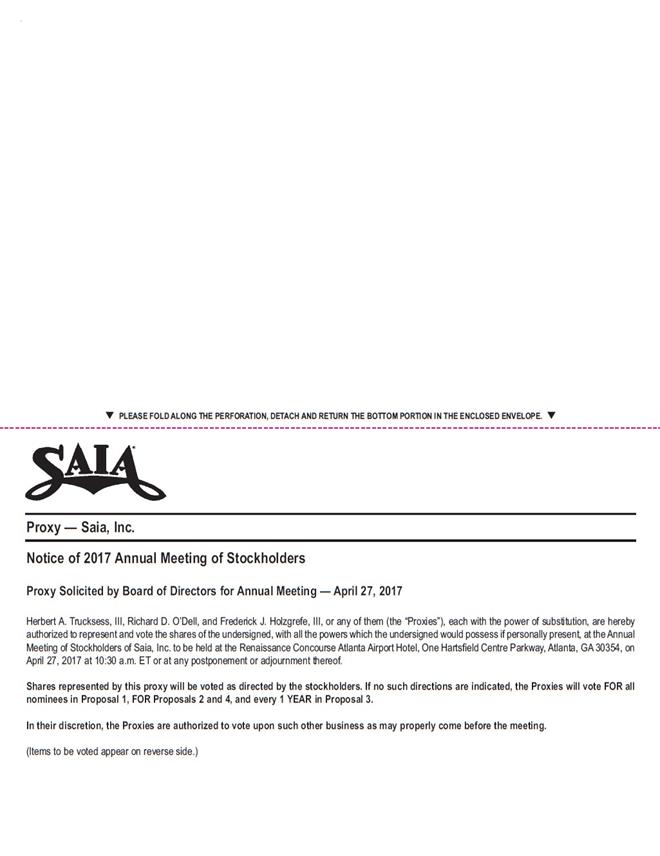

The Board of Directors (the “Board”) of Saia, Inc. (“Saia” or the “Company”) is furnishing you this proxy statement in connection with the solicitation of proxies on its behalf for the 20142017 annual meeting of stockholders. The meeting will take place at the Renaissance Concourse Atlanta Airport Hotel, One Hartsfield Centre Parkway, Atlanta, Georgia 30354 on April 24, 201427, 2017 at 10:30 a.m. local time. At the meeting, stockholders will vote on (a) the election of three directors, (b) an advisory basis to approve the compensation of Saia’s Named Executive Officers, (c) an advisory basis on the frequency of future advisory votes on the compensation of Saia’s Named Executive Officers, (d) the ratification of the appointment of KPMG LLP as Saia’s independent registered public accounting firm for fiscal year 2014,2017, and (d)(e) the transaction of any other business that may properly come before the meeting, and any postponement or adjournment of the meeting, although we know of no other business to be presented. By submitting your proxy (either by signing and returning the enclosed proxy card or by voting electronically on the internet or by telephone), you authorize Herbert A. Trucksess, III, Chairman of the Board, Richard D. O’Dell, Saia’s President and Chief Executive Officer, and James A. Darby,Frederick J. Holzgrefe, III, Saia’s Vice President —of Finance, Chief Financial Officer and Secretary, to represent you and vote your shares at the meeting in accordance with your instructions. They also may vote your shares to adjourn the meeting and will be authorized to vote your shares at any postponements or adjournments of the meeting. Saia’s Annual Report to Stockholders for the fiscal year ended December 31, 2013,2016, which includes Saia’s audited annual consolidated financial statements, accompanies this proxy statement. Although the Annual Report is being distributed with this proxy statement, it does not constitute a part of the proxy solicitation materials and is not incorporated by reference into this proxy statement. We are first sending this proxy statement, form of proxy and accompanying materials to stockholders on or about March 21, 2014.2017. | | | YOUR VOTE IS IMPORTANT. WHETHER OR NOT YOU PLAN TO ATTEND THE MEETING, PLEASE PROMPTLY SUBMIT YOUR PROXY EITHER IN THE ENCLOSED ENVELOPE, VIA THE INTERNET OR BY TELEPHONE. | | |

INFORMATION ABOUT THE ANNUAL MEETING What is the purpose of the annual meeting? At the annual meeting, the stockholders will be asked to: 1. Elect three directors, each for a term of three years;

2. Vote on an advisory basis to approve the compensation of Saia’s Named Executive Officers; and

3. Ratify the appointment of KPMG LLP as Saia’s independent registered public accounting firm for fiscal year 2014.

| 1. | Elect three directors, each for a term of three years; |

| 2. | Vote on an advisory basis to approve the compensation of Saia’s Named Executive Officers; |

| 3. | Vote on an advisory basis on the frequency of future advisory votes on the compensation of Saia’s Named Executive Officers; and |

| 4. | Ratify the appointment of KPMG LLP as Saia’s independent registered public accounting firm for fiscal year 2017. |

Stockholders also will transact any other business that may properly come before the meeting. Members of Saia’s management team and a representative of KPMG LLP, Saia’s independent registered public accounting firm, will be present at the annual meeting to respond to appropriate questions from stockholders.

Who is entitled to vote? You may vote if you owned shares of our common stock at the close of business on March 10, 2014,8, 2017, the record date for the annual meeting, provided such shares are held directly in your name as the stockholder of record or are held for you as the beneficial owner through a bank, broker or other nominee. Each outstanding 1

share of common stock is entitled to one vote for all matters that properly come before the annual meeting for a vote. At the close of business on the record date, there were 24,662,20525,446,515 shares of Saia common stock outstanding and entitled to vote. What is the difference between a stockholder of record and a beneficial owner of shares held in street name? Stockholders of Record.Record. If your shares are registered directly with our transfer agent, Computershare Trust Company, N.A., you are considered the stockholder of record with respect to those shares, and these proxy materials are being sent directly to you by us. As the stockholder of record, you have the right to grant your voting proxy directly to us through the enclosed proxy card or to vote in person at the annual meeting. Beneficial Owners.Owners. Many of our stockholders hold their shares through a bank, broker or other nominee rather than directly in their own name. If your shares are held in a stock brokerage account or by a bank or other nominee, you are considered the beneficial owner of shares held in street name, and these proxy materials (including a voting instruction card) are being forwarded to you by your bank, broker or nominee who is considered the stockholder of record with respect to those shares. As the beneficial owner, you have the right to direct your bank, broker or nominee on how to vote your shares. As the beneficial owner of shares, you are also invited to attend the annual meeting. However, since you are not the stockholder of record, you may not vote your shares in person at the annual meeting unless you obtain a legal proxy from your bank, broker or nominee and present it at the 20142017 annual meeting. Your bank, broker or nominee has enclosed a voting instruction card for you to use in directing the bank, broker or nominee regarding how to vote your shares. How do I vote? Stockholders of Record. 1.1.You May Vote by Mail.Mail. If you properly complete and sign the accompanying proxy card and return it in the enclosed envelope, it will be voted in accordance with your instructions. The enclosed envelope requires no additional postage if mailed in either the United States or Canada. 2.2.You May Vote by Telephone or the Internet.Internet. You may vote by telephone or on the internet by following the instructions included on the proxy card. If you vote by telephone or on the internet, you do not have to mail in your proxy card. Internet and telephone voting are available 24 hours a day. Votes submitted through the internet (www.investorvote.com/SAIA) or by telephone (1-800-652-8683) must be received by 11:59 p.m. Eastern time on April 23, 2014.26, 2017. | NOTE: | NOTE: | If you are a registered stockholder, you may elect to have next year’s proxy statement and annual report made available to you via the internet. We strongly encourage you to enroll in this service. It is a cost-effective way for us to send you proxy materials and annual reports. |

3.3.You May Vote in Person at the Meeting.Meeting. You may deliver your completed proxy card in person. Additionally, we will pass out written ballots to registered stockholders who wish to vote in person at the meeting. Beneficial Owners. If you hold your shares in street name, follow the voting instruction card you receive from your bank, broker or other nominee. If you want to vote in person at the annual meeting, you must obtain a legal proxy from your bank, broker or nominee and present it at the annual meeting. Can I change my vote? Stockholders of Record.Record. You may change your vote at any time before the proxy is exercised by voting in person at the annual meeting, giving written notice to Saia’s Secretary revoking your proxy, submitting a properly

signed proxy bearing a later date or voting again by telephone or on the internet (your latest telephone or internet vote is counted). 2

Beneficial Owners.Owners. If you hold your shares through a bank, broker or other nominee, you may change your vote by submitting new voting instructions following the instructions provided by your bank, broker or nominee. What if I do not vote for some of the items listed on the proxy card or voting instruction card? Stockholders of Record.Record. If you indicate a choice with respect to any matter to be acted upon on your proxy card, the shares will be voted in accordance with your instructions. Proxy cards that are signed and returned, but do not contain voting instructions with respect to a proposal, will be voted in accordance with the recommendations of the Board with respect to that proposal. Beneficial Owners. If you indicate a choice with respect to any matter to be acted upon on your voting instruction card, the shares will be voted in accordance with your instructions. If you do not indicate a choice with respect to a proposal or do not return your voting instruction card, the bank, broker or other nominee will determine if it has the discretionary authority to vote your shares. Regulations prohibit banks, brokers and other nominees from voting shares in elections of directors, or as to compensation of Named Executive Officers, and the frequency of future advisory votes on the compensation of Named Executive Officers unless the beneficial owners indicate how the shares are to be voted. Therefore, unless you instruct your bank, broker or nominee on how to vote your shares with respect to the election of directors, the compensation of Saia’s Named Executive Officers, and the frequency of future advisory votes on the compensation of Saia’s Named Executive Officers, your bank, broker or nominee will be prohibited from voting on your behalf on any such matter for which your instructions are not provided. As such, it is critical that you cast your vote if you want it to count for the proposals regarding the aforementioned matters. Your bank, broker or nominee will, however, continue to have discretionary authority to vote uninstructed shares on the ratification of the appointment of the Company’s independent registered public accounting firm. How many shares must be present to hold the meeting? A quorum must be present at the annual meeting for any business to be conducted. The presence at the annual meeting, in person or by proxy, of the holders of a majority of the shares of Saia common stock outstanding on the record date will constitute a quorum. Abstentions and broker non-votes (which occur when a bank, broker or other nominee holding shares for a beneficial owner does not have discretionary voting authority with respect to a proposal and has not received instructions with respect to that proposal from the beneficial owner) will be treated as shares present for purposes of determining whether a quorum is present. What if a quorum is not present at the meeting? If a quorum is not present at the scheduled timestart of the meeting, the stockholders who are represented may adjourn the meeting until a quorum is present. The time and place of the adjourned meeting will be announced at the time the adjournment is taken, and so long as the adjournment is not for longer than 30 days, no other notice will be given. How does the Board of Directors recommend I vote on the proposals? Your Board recommends that you vote: FOR the election of the three nominees to the Board of Directors; FOR the compensation of Saia’s Named Executive Officers as presented in Proposal 2; To conduct future advisory votes on the compensation of Saia’s Named Executive Officers EVERY YEAR; and FOR the ratification of KPMG LLP as Saia’s independent registered public accounting firm.

Will any other business be conducted at the meeting? We know of no other business that will be presented at the meeting. If any other matter properly comes before the stockholders for a vote at the meeting, the proxy holders will vote your shares in accordance with their best judgment. 3

Who will count the votes? Saia’s transfer agent, Computershare Trust Company, N.A., will tabulate and certify the votes. Douglas L. Col, the Company’s Treasurer and Assistant Secretary, will serve as the inspector of elections. How many votes are required to elect the director nominees? Because this is considered an uncontested election under the Company’s Bylaws, a nominee for director is elected to the Board if the votes cast for such nominee’s election exceed the votes cast against such nominee’s election. Abstentions will not affect the election of directors. In tabulating the voting results for the election of directors, only “FOR” and “AGAINST” votes are counted. If an incumbent director fails to receive a majority of the vote for re-election, the Nominating and Governance Committee of the Board will act on an expedited basis to determine whether to accept the director’s previously tendered irrevocable resignation and will submit such recommendation for prompt consideration by the Board. In considering whether to accept or reject the tendered resignation, the Nominating and Governance Committee and the Board will consider any factors they deem relevant in deciding whether to accept a director’s resignation.relevant. Any director who tenders his or her resignationfails to receive a majority of the vote for re-election pursuant to this provision of the Corporate Governance Guidelines will not participate in the Nominating and Governance Committee recommendation or Board consideration regarding whether or not to accept the tendered resignation. What happens if a nominee is unable to stand for election? If a nominee is unable to stand for election, the Board of Directors may either reduce the number of directors to be elected or select a substitute nominee. If a substitute nominee is selected, the proxy holders will vote your shares for the substitute nominee unless you have withheld authority. How many votes are required to approve the proposals other than the director nomination proposal? The advisory approval of the compensation of Saia’s Named Executive Officers and the ratification of the appointment of KPMG LLP as Saia’s independent registered public accounting firm each require the affirmative vote of a majority of the shares present at the meeting in person or by proxy and entitled to vote. With respect to the proposal to provide an advisory vote on the frequency of the advisory vote on executive compensation, the option that receives the greatest number of votes cast – “EVERY YEAR,” “EVERY TWO YEARS,” or “EVERY THREE YEARS” – shall constitute the shareholder’s advisory vote on the frequency of voting by stockholders on the compensation of Saia’s Named Executive Officers. What effect will abstentions and broker non-votes have on the proposals? Shares voting “ABSTAIN” with respect to any nominee for director or on the advisory vote on the frequency of future advisory votes on executive compensation will be excluded entirely from the vote and will have no effect on the proposal. Shares voting “ABSTAIN” on the advisory vote on executive compensation, and the ratification of the appointment of the Company’s independent registered public accounting firm will be treated as shares present for quorum purposes and entitled to vote, so they will have the same practical effect as votes against the proposals. In tabulating the voting results for any particular proposal, shares that constitute broker non-votes are not considered entitled to vote on that proposal. Thus, broker non-votes will not affect the outcome of any matter being voted on at the meeting, assuming that a quorum is obtained.

When will the Company announce the voting results? We will announce the preliminary voting results at the annual meeting. The Company will report the final results in a Current Report on Form 8-K filed with the Securities and Exchange Commission within four business days following the annual meeting.

4

PROPOSALPROPOSAL 1

ELECTION OF DIRECTORS The Board of Directors currently consists of nine directors divided into three classes (Class I, Class II and Class III). Directors in each class are elected to serve for three-year terms that expire in successive years. The terms of the Class III directors will expire at the upcoming annual meeting. The Board of Directors has nominated Linda J. French, William F. Martin,John P. Gainor, Jr., Randolph W. Melville and Björn E. Olsson for election as Class III directors for three-year terms expiring at the annual meeting of stockholders to be held in 20172020 and until their successors are elected and qualified. Ms. French and Messrs. Martin, Jr.Gainor, Melville and Olsson currently serve as Class III directors. Each nominee has consented to being named in this proxy statement and has agreed to serve if elected. If a nominee is unable to stand for election, the Board of Directors may either reduce the number of directors to be elected or select a substitute nominee. If a substitute nominee is selected, the proxy holders will vote your shares for the substitute nominee, unless you have withheld authority. Because this is considered an uncontested election under the Company’s Bylaws, a nominee for director is elected to the Board if the votes cast for such nominee’s election exceed the votes cast against such nominee’s election. Abstentions will not affect the election of directors. In tabulating the voting results for the election of directors, only “FOR” and “AGAINST” votes are counted. If an incumbent director fails to receive a majority of the vote for re-election, the Nominating and Governance Committee of the Board will act on an expedited basis to determine whether to accept the director’s previously tendered irrevocable resignation and will submit such recommendation for prompt consideration by the Board. In considering whether to accept or reject the tendered resignation, the Nominating and Governance Committee and the Board will consider any factors they deem relevant in deciding whether to accept a director’s resignation.relevant. Any director who tenders his or her resignationfails to receive a majority of the vote for re-election pursuant to this provision of the Corporate Governance Guidelines will not participate in the Nominating and Governance Committee recommendation or Board consideration regarding whether or not to accept the tendered resignation. YOUR BOARD OF DIRECTORS RECOMMENDS THAT YOU VOTE “FOR” THE ELECTION OF EACH OF THE THREE NOMINEES. The following tables set forth certain information regarding each nominee for director and continuing director of the Company. The information presented includes information provided to the Company by each nominee and continuing director including such person’s name, age, principal occupation and business experience for at least the past five years, the names of other publicly-held companies of which such person currently serves as a director or has served as a director during the past five years and the year in which the nominee first became a director of Saia. The Board of Directors has determined that the following seven directors of Saia satisfyare deemed “independent” pursuant to the NASDAQ Global Select Market’s (“NASDAQ”) definition of independent director: William F. Evans, Linda J. French,John P. Gainor, Jr., John J. Holland, William F. Martin, Jr.,Randolph W. Melville, Björn E. Olsson, Douglas W. Rockel and Jeffrey C. Ward. In addition to the information presented below regarding the specific experience, qualifications, attributes and skills of each nominee and director that led the Board of Directors to the conclusion that such person should serve as a director, the Board also believes that all of the nominees and continuing directors have a reputation for high personal and professional ethics, integrity, values and character. Each nominee and continuing director brings a strong and unique background and set of skills to the Board of Directors giving the Board as a whole competence and experience in a wide variety of areas, including corporate governance and board service, executive management, lawsales and regulation,marketing, the less-than-truckload (“LTL”) and transportation industry, accounting and finance, and risk assessment. They have demonstrated business acumen and an ability to exercise sound judgment, as well as a commitment of service to the Company and the Board. Each nominee and continuing director is committed to achieving, monitoring and improving on the Company’s business strategy.

5

Current Nominees NOMINEES FOR ELECTION AS CLASS III DIRECTORS FOR A THREE-YEAR

TERM EXPIRING AT THE 20172020 ANNUAL MEETING

| | | | | | | Director, Year first ElectedFirst Serving as Director | | Age | | | Age | | Principal Occupation, Business Experience and Directorships | Linda J. French, 2004John P. Gainor, Jr., 2016(1)

| | | 66 | | | Ms. French is retired from her position60

| | Since 2008, Mr. Gainor has served as assistant professorthe President and CEO of International Dairy Queen, a subsidiary of Berkshire Hathaway. Mr. Gainor has been with International Dairy Queen since 2003 and served as its Chief Supply Chain Officer prior to being named President and CEO. From 2000-2003, Mr. Gainor was President and Co-Founder of Supply Solutions, Inc., a company that focused on designing and implementing supply chain solutions and business administration at William Jewell College in Liberty, Missouri, where she served from 1997 to 2001. Prior to joining the William Jewell faculty, Ms. French was a partner at the law firm of Husch Blackwell Sanders LLP (now Husch Blackwell LLP)expansion models for approximately four yearsmajor restaurant chains and anconsumer products companies. Mr. Gainor has also held various executive officer of Payless Cashways, Inc. for approximately 12 years.positions focusing on logistics, supply chain and transportation with Consolidated Distribution Corporation, AmeriServe Distribution Corporation, and Warner Lambert Corporation. | | | | | | | Ms. French

Mr. Gainor brings a wide variety ofsignificant business experience to the Board as President and CEO of an executive officerinternationally-known fast food restaurant chain, and general counselover thirty years of a public company, a partner in a major law firm and an assistant professor of business administration. Additionally, Ms. French has particular experience in human resource, governancelogistics, supply chain and ethics matters. Ms. French also has extensive knowledge of Saia and the LTL industry having served on the Board of Saia since 2004.transportation. | William F. Martin, Jr., 2004Randolph W. Melville, 2015(1)

| | 58 | 66 | | | Mr. Martin retiredMelville is currently the Senior Vice President and General Manager for the Western Division of PepsiCo’s Frito-Lay North America. He is accountable for all aspects of the company’s western division performance, including sales, operations, supply chain, finance, human resources and strategic planning. Mr. Melville also served as an independent director and member of the compensation committee of Interline Brands, Inc. Prior to his 20-plus years at Frito-Lay, Mr. Melville served as a Senior Vice President at Maytag Corporation from Yellow Corporation1999-2001 and held various sales and marketing leadership positions with Procter & Gamble Distributing Company from 1981 to 1993. Mr. Melville brings significant national sales, marketing and operations experience to the Board. Mr. Melville also has substantial expertise in 2002 after 25 yearsthe areas of service. He had been senior vice presidentdistribution, international business and human resources and adds valuable perspectives complementing those of legal, general counsel and corporate secretary.the current board members. | | | | | | | As a former general counsel

(1) Mr. Gainor and executive officer of a large publicly-traded LTL carrier, Mr. Martin brings toMelville were appointed by the Board extensive experience in the LTL industry, including in the area of risk assessment, and the regulation and governance of public companies in general.to fill vacancies, so this is their first election. |

Björn E. Olsson, 2005 | | 71 | 68 | | | Mr. Olsson served on the Resident Management Team at George K. Baum & Company, an investment bank, from September 2001 to September 2004. Prior to that time Mr. Olsson was President and Chief Executive Officer/Chief Operating Officer of Harmon Industries, Inc., a publicly-traded supplier of signal and train control systems to the transportation industry, from August 1990 to November 2000. | | | | | | | Mr. Olsson brings to the Board operational and leadership experience as the Chief Executive Officer of a publicly-traded supplier of equipment to the railroad industry. Additionally, Mr. Olsson’s experience as a former director of three public companies and the Chief Financial Officer of a public company in Sweden aids his service to the Board. Mr. Olsson also has extensive knowledge of Saia and the LTL industry having served on the Board of Saia since 2005. Mr. Olsson served as Lead Independent Director in 2016. |

6

Continuing Directors CLASS I DIRECTORS CONTINUING IN OFFICE

WHOSE TERMS EXPIRE AT THE 20152018 ANNUAL MEETING

| | | | | | | Director, Year First Elected as Director | | Age | | | Age | | Principal Occupation, Business Experience and Directorships | William F. Evans, 2013 | | 69 | 66 | | | From May 2002 to June 2007, Mr. Evans was Executive Vice President and Chief Financial Officer of Witness Systems, Inc., a publicly-traded workforce optimization services and software provider. He has beenwas a director of ValueVision Media, Inc., a publicly-traded multichannel electronics retailer, since 2011.from 2011 to 2014. From 1993 to 2011, he served as a director of SFN Group, Inc., a publicly-traded company that provided temporary and permanent staffing solutions to businesses. From 2008 to 2010, he served as a director of Wolverine Tube, Inc., a publicly-traded company in the tubing, fabricated products and metal joining products industry. | | | | | | | Mr. Evans brings to the Board professional experience as a Chief Financial Officer of multiple publicly-traded companies, significant finance and accounting expertise as a director of other public companies and experience as a partner in a public accounting firm. Mr. Evans qualifies as an “audit committee financial expert.” | Herbert A. Trucksess, III, 2000 | | 67 | 64 | | | Mr. Trucksess is Chairman of the Board of Directors of Saia. He was named President and Chief Executive Officer of the Yellow Regional Transportation Group (now Saia, Inc.) in February 2000 and served as Chief Executive Officer until December 2006. Prior to leading Saia, Mr. Trucksess was Chief Financial Officer at Saia’s former parent, Yellow Corporation, and previously held executive positions with Preston Corporation, a holding company for regional LTL carriers that included the predecessor of Saia. Mr. Trucksess also served as a director of School Specialty, Inc., a publicly-traded provider of educational products and services, from 2007 to 2013. | | | | | | | Mr. Trucksess brings to the Board more than 2530 years of experience in the LTL industry, extensive knowledge of the Company’s operations as the Company’s former Chief Executive Officer, extensive finance and accounting expertise, prior experience as the Chief Financial Officer of Yellow Corporation and experience as a director and audit committee chair of another public company. |

7

| | | | | | | Jeffrey C. Ward, 2006 | | 58 | 55 | | | Mr. Ward is a Vice President of A.T. Kearney, Inc., a global management consulting firm. Mr. Ward joined A.T. Kearney, Inc. in 1991. | | | | | | | Mr. Ward’s experience at A.T. Kearney is focused on the North American transportation market. Additionally, he has experience in a privately-held family LTL company. Mr. Ward brings to the Board significant knowledge in the areas of transportation, corporate and marketing strategy, post mergerpost-merger integration, restructuring and privatization, network operations, mergers and acquisitions and operations effectiveness. |

CLASS II DIRECTORS CONTINUING IN OFFICE

WHOSE TERMS EXPIRE AT THE 20162019 ANNUAL MEETING

| | | | | | | Director, Year First Elected as Director | | Age | | | Age | | Principal Occupation, Business Experience and Directorships | John J. Holland, 2002 | | 67 | 64 | | | Mr. Holland has served as the President of the International Copper Association, Ltd., an international trade association, since February 2012. Mr. Holland has also served as the President of Greentree Advisors, LLC, a business advisory firm, since October 2004. From February 2012 to November 2015, Mr. Holland also served as President of the International Copper Association, Ltd., an international trade association. From September 2008 to October 2009, Mr. Holland served as President, Chief Operating Officer and Chief Financial Officer of MMFX Technologies Corporation, a privately-held steel manufacturing firm. Previously, Mr. Holland served as Executive Vice President and Chief Financial Officer of Alternative Energy Sources, Inc., a publicly-traded ethanol company, from August 2006 to June 2008. Prior to that, Mr. Holland was the President and Chief Executive Officer and a director of Butler Manufacturing Company (“Butler”), a publicly-traded manufacturer of prefabricated buildings, from July 1999 to October 2004 and Chairman of the Board of Directors of Butler from November 2001 to October 2004. Mr. Holland has served as a member of the Board of Directors of Cooper Tire and Rubber Company since 2003 and NCI Building Systems, Inc., an integrated manufacturer and marketer of metal products, since 2009. | | | | | | | Mr. Holland brings to the Board operational and leadership experience as the Chief Executive Officer and Chief Financial Officer of publicly-traded companies, significant finance and accounting expertise, qualifying as an “audit committee financial expert,” experience as a director of other public companies and experience in public accounting as a certified public accountant. Mr. Holland also has extensive knowledge of Saia and the LTL industry having served on the Board of Saia since 2002. |

8

| | | | | | | Richard D. O’Dell, 2006 | | 55 | 52 | | | Mr. O’Dell has been President and Chief Executive Officer of Saia since December 2006 and has served as President of Saia since July 2006. In 1997, Mr. O’Dell joined Saia LTL Freight, the principal operating subsidiary of the Company, as Chief Financial Officer. He continued in that position until his appointment as President and CEO of Saia LTL Freight in 1999. | | | | | | | As a long-time executive of the Company, Mr. O’Dell brings extensive knowledge and understanding of the Company and the LTL industry to the Board. Additionally, he has experience in public accounting as a certified public accountant. |

Douglas W. Rockel, 2002 | | 60 | 57 | | | Mr. Rockel has been President, Chief Executive Officer and Chairman of the Board of Directors of Roots, Inc., a private commercial real estate development and investment company, since August 2001. Prior to that, he was a Senior Vice President with ABN Amro Securities (formerly ING Barings) from February 1997 to July 2001. | | | | | | | Mr. Rockel’s approximately 15 years of experience as a securities analyst with a particular focus on the transportation industry and his experience with a development and investment company give him significant insight in our industry and in how to build and maintain value for stockholders. Further, Mr. Rockel has extensive finance and accounting expertise and qualifies as an “audit committee financial expert.” Mr. Rockel also has extensive knowledge of Saia and the LTL industry having served on the Board of Saia since 2002. |

9

CORPORATE GOVERNANCEGOVERNANCE THE BOARD, BOARD MEETINGS AND COMMITTEES The system of governance practices followed by the Company is memorialized in the Company’s Bylaws, in the charters of the three standing committees of the Board of Directors (the Audit Committee, the Compensation Committee and the Nominating and Governance Committee) and in the Company’s Corporate Governance Guidelines. The committee charters and Corporate Governance Guidelines are intended to provide the Board with the necessary authority and practices to review and evaluate the Company’s business and to make decisions independent of the influence of the Company’s management. The Corporate Governance Guidelines establish guidelines for the Board with respect to Board meetings, Board composition, selection and election of directors, director responsibility, director access to management and independent advisors and non-employee director compensation. The committee charters and the Corporate Governance Guidelines are reviewed annually by the Board and updated as necessary to reflect evolving governance practices and changes in regulatory requirements. The Corporate Governance Guidelines and each of the Board’s committee charters are available free of charge on the Company’s website (www.saiacorp.com) under the investor relations section. The Company has adopted a Code of Business Conduct and Ethics applicable to all directors, officers and employees, including its principal executive officer, principal financial officer and principal accounting officer. The Code of Business Conduct and Ethics is filed as Exhibit 14.1 to the Company’s Annual Report on Form10-K for the fiscal year ended December 31, 20132014, and incorporated by reference into the Company’s Annual Report on Form 10-K for the fiscal year ended December 31, 2016, filed with the Securities and Exchange Commission. Board Leadership Structure Saia’s Board structure provides for a Chief Executive Officer separate from the Chairman of the Board. The Board believes having a separate Chairman and Chief Executive Officer allows each to more fully focus on their applicable responsibilities. Further, maintaining separate roles allows the Chairman to adequately oversee the Chief Executive Officer’s performance and remain more impartial when governing the Board. The Chief Executive Officer is responsible for setting the strategic direction for the Company and managing the day-to-day leadershipoperation and performance of the Company, while the Chairman provides guidance to the Chief Executive Officer, and sets the agenda for Board meetings and presides over meetings of the full Board. Additionally, the Board has created aThe Lead Independent Director position in order to have a director in a leadership position who is “independent” under all applicable rules of the NASDAQ Global Select Market and the Securities and Exchange Commission. The Lead Independent DirectorCommission and is elected annually by the independent directors. For 2013,2016, the Lead Independent Director was Björn E. Olsson. The primary responsibilities of the Lead Independent Director are to:

set jointly with the Chairman of the Board the schedule for Board meetings and provide input to the Chairman concerning the agenda for Board meetings; advise the Chairman as to the quality, quantity and timeliness of the flow of information to the non-employee directors; chair all meetings of the Board at which the Chairman is not present; coordinate, develop the agenda for, chair and moderate meetings of independent directors, and generally act as principal liaison between the independent directors and the Chairman; provide input to the Board concerning the Chief Executive Officer’s performance; and provide input to the Nominating and Governance Committee regarding the appointment of chairs and members of the various committees.

In addition, the Lead Independent Director has the authority to call meetings of independent directors. If requested by major stockholders, the Lead Independent Director will make himself reasonably available for direct communication. 10

Meetings The Board of Directors held sevenfive meetings in 2013.2016. Each director attended at least 75% of the meetings convened by the Board and the applicable committees during such director’s service on the Board during 2013.2016. Executive sessions of non-employee directors and separate executive sessions of independent directors are held as part of each regularly scheduled meeting of the Board. The sessions of the independent directors are chaired by the Lead Independent Director. Board Committees The Board of Directors has an Audit Committee, a Compensation Committee and a Nominating and Governance Committee, each of which is comprised entirely of independent directors. Current Committee memberships are as follows: | | | | | Audit Committee | | Compensation Committee | | Nominating and Governance Committee | William F. Evans, Chair | | John J. Holland, Chair | | Linda J. French, Chair | | William F. Martin, Jr., Chair | William F. Evans | | Björn E. Olsson, | | Björn E. Olsson Chair | William F. Martin,John P. Gainor, Jr. | | Randolph W. Melville | | Douglas W. Rockel | John J. Holland Douglas W. Rockel | | Jeffrey C. Ward | | Douglas W. Rockel | Douglas W. Rockel | | | | Jeffrey C. Ward |

Through her retirement from the Board of Directors in February 2017, Linda French was a member of the Compensation Committee. Audit Committee The Audit Committee has been established in accordance with Section 3(a)(58)(A) of the Securities Exchange Act of 1934, as amended (the “Securities Exchange Act of 1934”). The Audit Committee held five meetings in 2013.2016. The functions of the Audit Committee are described in the Audit Committee charter and include, among others, the following: review the adequacy and quality of Saia’s accounting and internal control systems; review Saia’s financial reporting process on behalf of the Board of Directors; oversee the entire audit function, both internal and independent, including the selection of the independent registered public accounting firm; examinereview the Company’s major financial reporting exposures concerning risk assessment and management and the steps management has taken to monitor and control such exposures; and

provide an effective communication link between the auditors (internal and independent) and the Board of Directors. Each member of the Audit Committee meets the independence and experience requirements for audit committee members as established by The NASDAQ Global Select Market. The Board of Directors has determined that Mr. Evans, Mr. Holland and Mr. Rockel are “audit committee financial experts,” as defined by applicable rules of the Securities and Exchange Commission.

Compensation Committee The Compensation Committee held sevenfive meetings in 2013.2016. The functions of the Compensation Committee are described in the Compensation Committee charter and include, among others, the following: recommend to the Boarddetermine the salaries, bonuses and other remuneration and terms and conditions of employment of the Named Executive Officers of Saia;

supervise the administration of Saia’s incentive compensation and equity-based compensation plans and approve grants under those plans; and make recommendations to the Board of Directors with respect toestablish Saia’s executive officer compensation policies and recommend to the Board the compensation of non-employee directors.

11

Each member of the Compensation Committee qualifies as (i) an independent director under applicable NASDAQ rules and Rule 10C-1 of the Securities Exchange Act of 1934; (ii) an “outside director” for purposes of Section 162(m) of the Internal Revenue Code of 1986 (the “Internal Revenue Code”), as amended; and (iii) a “non-employee director” for purposes of Rule 16b-3 of the Securities Exchange Act of 1934. Nominating and Governance Committee The Nominating and Governance Committee held fourtwo meetings in 2013.2016. The functions of the Nominating and Governance Committee are described in the Nominating and Governance Committee charter and include, among others, the following: review the size and composition of the Board and make recommendations to the Board as appropriate; review criteria for election to the Board and recommend candidates for Board membership; review the structure and composition of Board committees and make recommendations to the Board as appropriate; develop and oversee an annual self-evaluation process for the Board and its committees; review the Company’s major enterprise risk assessment and management processes for matters other than financial reporting risk matters; provide oversight of corporate ethics issues and at least annually assess the adequacy of the Company’s Code of Business Conduct and Ethics; and provide oversight on management succession issues. Each member of the Nominating and Governance Committee meets the definition of an independent director under applicable NASDAQ rules. Risk Oversight The Board of Directors oversees an enterprise-wide approach to risk management, designed to support the achievement of Company objectives, improve long-term Company performance and create stockholder value. A fundamental part of risk management is not only understanding the risks the Company faces and what steps management is taking to manage those risks, but also understanding what level of risk is appropriate for the Company. The involvement of the full Board of Directors in setting the Company’s business strategy and objectives is integral to the Board’s assessment of the Company’s risk and also a determination ofin determining what constitutes an appropriate level of risk for the Company. The full Board of Directors conducts an annual risk assessment of the Company’s financial risk, legal/compliance risk and operational/strategic risk. The Board typically reviews at least one risk element in detail at each regular Board meeting and addresses individual risk issues throughout the year as necessary. While the Board of Directors has the ultimate oversight responsibility for the risk management process, the Board delegates responsibility for certain aspects of risk management to its committees. In particular, the Audit Committee focuses on key business and financial risks and related controls and processes. Per its charter, the Audit

Committee discusses with management the Company’s major financial reporting exposures concerning risk assessment and management and the steps management has taken to monitor and control such exposures. The Company’s Compensation Committee strives to create incentives that encourage a level of risk-taking behavior consistent with the Company’s business strategy and objectives and helps ensure that the Company’s compensation policies and practices are not reasonably likely to have a material adverse effect on the Company. The Compensation Committee structures the Company’s executive compensation program to reduce the possibility that Saia’s executive officers, either individually or as a group, make excessively risky business decisions that could maximize short-term results at the expense of long-term value. Finally, the Company’s Nominating and Governance Committee is responsible for overseeing the Company’s major non-financial reporting enterprise risk assessment and management processes. The Chair of the Nominating and Governance Committee discusses with both the Audit Committee and the Compensation Committee the processes used in the oversight of the non-financial reporting enterprise risk assessment and management processes. The Board believes its leadership structure enhances overall risk oversight. While the Board requires risk assessments from management, the combination of Board member experience, continuing education and independence of governance processes provide an effective basis for testing, overseeing and supplementing management assessments. assessments of risk.12

ELECTION OF DIRECTORS Election to the Company’s Board of Directors in a contested election is by a plurality of the votes cast at any meeting of stockholders.stockholders having a quorum. An election will be considered contested if (i) the Secretary of the Company receives a notice that a stockholder has nominated a person for election to the Board of Directors in compliance with the advance notice requirements for stockholder nominees for director set forth in the Company’s Bylaws and (ii) such nomination has not been withdrawn by such stockholder on or before the 10th day before the Company first mails its notice of meeting for such meeting to the stockholders. If directors are to be elected by a plurality of the votes cast, stockholders are not permitted to vote against a nominee. In an uncontested election, directors are elected by a majority of the votes cast “FOR” and “AGAINST” at any meeting of stockholders.stockholders having a quorum. If an incumbent director fails to receive a majority of the vote for re-election in an uncontested election, the Nominating and Governance Committee will act on an expedited basis to determine whether to accept the director’s previously tendered irrevocable resignation and will submit such recommendation for prompt consideration by the Board. In considering whether to accept or reject the tendered resignation, the Nominating and Governance Committee and the Board will consider any factors they deem relevant in deciding whether to accept a director’s resignation.relevant. Any director who tenders his or her resignationfails to receive a majority of the vote for re-election pursuant to this provision of the Corporate Governance Guidelines will not participate in the Nominating and Governance Committee recommendation or Board consideration regarding whether or not to accept the tendered resignation. The election of directors at the 20142017 annual meeting of the Company’s stockholders is an uncontested election. The Board will nominate for election or re-election as director only candidates who agree to tender irrevocable resignations that will be effective upon (i) the failure to receive the required vote at the next annual meeting at which they will face re-election and (ii) Board acceptance of such resignation. The Board will fill director vacancies and new directorships only with candidates who agree to tender, promptly following their appointment to the Board, the same form of resignation tendered by other directors in accordance with the Corporate Governance Guidelines.

CONSIDERATION OF DIRECTOR NOMINEES Director Qualifications The Corporate Governance Guidelines include director qualification standards which provide as follows: A majority of the members of the Board of Directors must qualify as independent directors in accordance with the rules of The NASDAQ Global Select Market; No member of the Board of Directors should serve on the Board of Directors of more than three other public companies; No person may stand for election as a director of the Company after reaching age 72; and No director shall serve as a director, officer or employee of a competitor of the Company. While the selection of qualified directors is a complex, subjective process that requires consideration of many intangible factors, the Corporate Governance Guidelines provide that directors and candidates for director generally should, at a minimum, meet the following criteria: Directors and candidates should have high personal and professional ethics, integrity, values and character and be committed to representing the best interests of the Company and its stockholders; Directors and candidates should have experience and a successful track record at senior policy-making levels in business, government, technology, accounting, law and/or administration; Directors and candidates should have sufficient time to devote to the affairs of the Company and to enhance their knowledge of the Company’s business, operations and industry; and 13

Directors and candidates should have expertise or a breadth of knowledge about issues affecting the Company that is useful to the Company and complementary to the background and experience of other Board members. In considering whether to recommend any candidate as a director nominee, including candidates recommended by stockholders in accordance with the procedures discussed below, the Nominating and Governance Committee will apply the criteria set forth in the Corporate Governance Guidelines. The Nominating and Governance Committee seeks nominees with a broad range of experience, professions, skills, geographic representation and backgrounds. The Nominating and Governance Committee does not assign specific weights to the criteria and no particular criterion is necessarily applicable to all prospective nominees. The Nominating and Governance Committee believes that the backgrounds and qualifications of the directors, considered as a group, should provide a significant composite mix of experience, knowledge and abilities that will allow the Board to fulfill its responsibilities. The Nominating and Governance Committee assesses the effectiveness of the Corporate Governance Guidelines, including with respect to director nominations and qualifications and achievement of having directors with a broad range of experience and backgrounds, through completion of the committee’s annual self-evaluation process. Procedures for Recommendations and Nominations by Stockholders Stockholder Recommendations The Nominating and Governance Committee has adopted policies concerning the process for the consideration of director candidates recommended by stockholders. The Nominating and Governance Committee will consider director recommendations from stockholders. Any stockholder wishing to recommend a candidate for consideration should send the following information to the Secretary of the Company, Saia, Inc., 11465 Johns Creek Parkway, Suite 400, Johns Creek, Georgia 30097: The name and address of the recommending stockholder as it appears on the Company’s books; The number and class of shares owned beneficially and of record by such stockholder, the length of period held and proof of ownership of such shares;

If the recommending stockholder is not a stockholder of record, a statement from the record holder of the shares (usually a broker or bank) verifying the holdings of the stockholder and a statement from the recommending stockholder of the length of time that the shares have been held. (Alternatively, the stockholder may furnishheld (or a current Schedule 13D, Schedule 13G, Form 3, Form 4 or Form 5 filed with the Securities and Exchange Commission reflecting the holdings of the stockholder, together with a statement of the length of time that the shares have been held); and A statement from the stockholder as to whether the recommending stockholder has a good faith intention to continue to hold the reported shares through the date of the Company’s next annual meeting of stockholders. The recommendation must be accompanied by the information concerning the candidate required to be disclosed in solicitations of proxies for election of directors in an election contest, or is otherwise required, in each case pursuant to the Securities Exchange Act of 1934 and rules adopted thereunder, generally providing for the disclosure of: The name and address of the candidate, any arrangements or understanding regarding nomination, the candidate’s business experience and public company directorships during the past five years and information regarding certain types of legal proceedings within the past ten years involving the candidate and a statement of the particular experience, qualifications, attributes or skills that made the candidate appropriate for service on the Board; The candidate’s ownership of securities in the Company; and Transactions between the Company and the candidate valued in excess of $120,000 and certain other types of business relationships with the Company. 14

The recommendation must describe all relationships between the candidate and the recommending stockholder and any agreements or understandings between the recommending stockholder and the candidate regarding the recommendation. The nominating recommendation shall describe all relationships between the candidate and any of the Company’s competitors, customers, suppliers or other persons with special interests regarding the Company. The recommending stockholder must furnish a statement supporting its view that the candidate possesses the minimum qualifications prescribed by the Nominating and Governance Committee for director nominees, and briefly describing the contributions that the nomineecandidate would be expected to make to the Board and to the governance of the Company. The recommending stockholder must state whether, in the view of the stockholder, the candidate, if elected, would represent all stockholders and not serve for the purpose of advancing or favoring any particular stockholder or other constituency of the Company. The nominating recommendation must be accompanied by the consent of the candidate to be interviewed by the Committee, if the Committee chooses to do so in its discretion (and the recommending stockholder must furnish the candidate’s contact information for this purpose), and, if nominated and elected, to serve as a director of the Company. If a recommendation is submitted by a group of two or more stockholders, the information regarding recommending stockholders must be submitted with respect to each stockholder in the group. The Secretary of Saia will promptly forward such materials to the Nominating and Governance Committee Chair and the Chairman of the Board of Saia. The Secretary will also maintain copies of such materials for future reference by the Committee when filling Board positions. If a vacancy arises or the Board decides to expand its membership, the Nominating and Governance Committee will seek recommendations of potential candidates from a variety of sources (including(potentially including incumbent directors, stockholders, and the Company’s management)management and professional recruitment firms). At that time, the Nominating and Governance Committee also will consider potential candidates submitted by stockholders in accordance with the procedures described above. The Nominating and Governance Committee then evaluates each potential candidate’s educational background, employment history, outside commitments and other relevant factors

to determine whether he or she is potentially qualified to serve on the Board. The Nominating and Governance Committee seeks to identify and recruit the best available candidates and it intends to evaluate qualified stockholder candidates on the same basis as those submitted by other sources. After completing this process, the Nominating and Governance Committee will determine whether one or more candidates are sufficiently qualified to warrant further investigation. If the process yields one or more desirable candidates, the Nominating and Governance Committee will rank them by order of preference, depending on their respective qualifications and Saia’s needs. The Nominating and Governance Committee Chair, or another director designated by the Nominating and Governance Committee Chair, will then contact the desired candidate(s) to evaluate their potential interest and to set up interviews with the full Nominating and Governance Committee. All such interviews are held in person and include only the candidate, andmembers of the Nominating and Governance Committee members.and other non-employee directors as determined by the Nominating and Governance Committee. At its sole discretion, the Nominating and Governance Committee may include other non-employee directors in the interviewing process. Based upon interview results, the candidate’s qualifications and appropriate background checks, the Nominating and Governance Committee then decides whether it will recommend the candidate’s nomination to the full Board. Stockholder Nominations and Proposals at Annual Meetings Separate procedures apply if a stockholder wishes to submit a director candidate at an annual meeting. To nominate a director candidate for election or submit a proposal for other business at an annual meeting, a stockholder must deliver timely notice of such nomination or proposal to the principal executive offices of the Company in accordance with, and containing the information required by, the Company’s Bylaws. To be timely, the notice must be received at the Company’s principal executive offices no later than the close of business on the 90th calendar day noror earlier than the 120th calendar day prior to the first anniversary date of the immediately preceding year’s annual meeting.